A Convergence of Thought Leadership on Climate Change and Real Estate

Scholars, industry experts, and policymakers come together to tackle growing economic and environmental challenges facing real estate

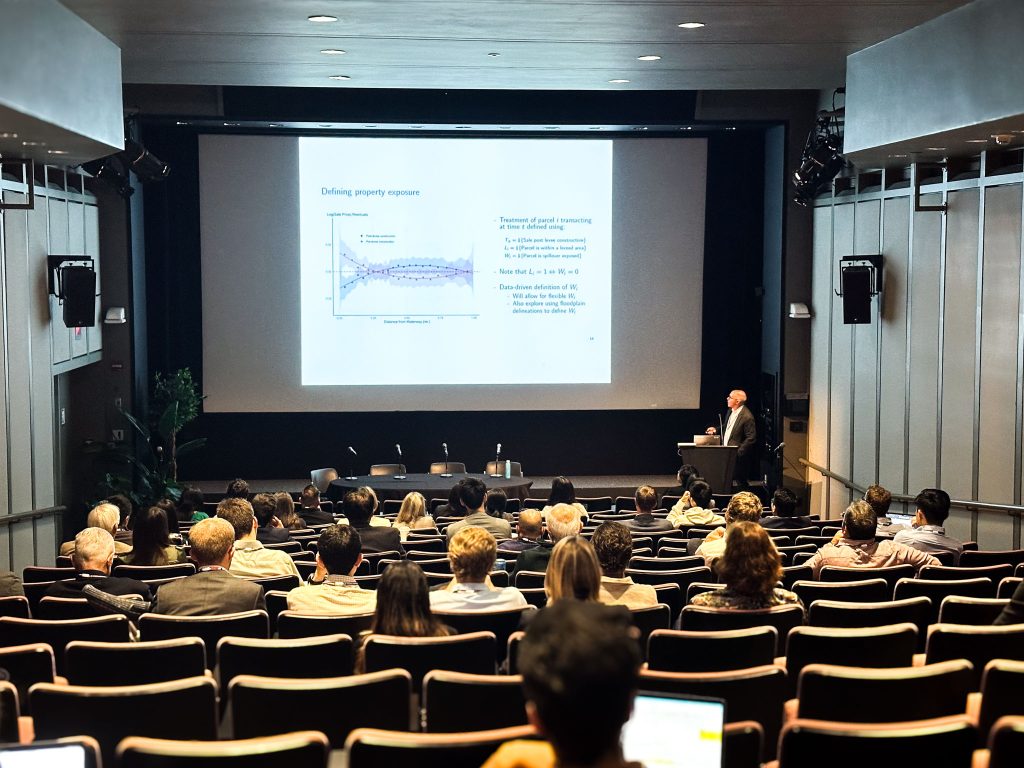

On October 4-5, 2024, the MIT Climate Change and Real Estate Symposium brought together over 60 scholars, industry experts, and policymakers to tackle the growing economic and environmental challenges facing the real estate sector due to climate change. Hosted at MIT’s Bartos Theater, the symposium emphasized the urgent need for mitigation and adaptation strategies, facilitating a high-level dialogue between academia and industry.

Day 1 – Resilience

The symposium kicked off with opening remarks from Siqi Zheng, STL Champion Professor of Urban and Real Estate Sustainability at MIT and Faculty Director of the MIT Center for Real Estate. Zheng stressed the need for evidence-based research to guide industry and policy in confronting climate risks.

After the opening remark, Joe Aldy, Teresa and John Heinz Professor of the Practice of Environmental Policy at the Harvard Kennedy School, gave a Keynote speech on using economic analyses to value the private benefits from public investment in climate adaptation and resilience. Prof. Aldy discussed the direct economic benefit in housing price appreciation after the construction of flood protection levees, and the spillover effects on neighboring areas. Most importantly, he emphasizes how the failure to consider the spillover externalities can cause the federal cost-benefit analyses to be misleading. The morning continued with research presentations then discussions focusing on land use and location choices as responses to climate risk:

- Abigail Ostriker of Boston University shared insights into floodplain regulations in Florida, showing that while these reduce construction in high-risk areas, but it incurs a higher cost than a first-best corrective tax.

- Yanjun Liao from Resources for the Future discussed the Coastal Barrier Resources System (CBRS), finding that removing federal development incentives in flood-prone areas reduces flood damages, shifts development to neighboring areas, and alters local demographics.

- Lu Han of the University of Wisconsin-Madison presented on the economic value of urban trees, showing how a single tree can increase property prices by 0.45%.

- Charles Taylor of Harvard University discussed “climate matching,” where migrants seek destinations with climates similar to their origin, shedding light on how this trend affects economic assessments of climate change impacts.

In the afternoon, Johannes Stroebel of NYU Stern delivered a compelling keynote on pricing climate risk in housing markets, cautioning against an “illusion of precision” in data analysis. He stressed the importance of integrating climate risk into financial models while recognizing the inconsistencies in current data.The afternoon research presentations and discussions centered around pricing climate risk:

- Lyndsey Rolheiser of York University shared research on the impact of wildfire smoke on commercial real estate markets and how it leads to lower rents and shorter lease terms.

- Glen Gostlow from the University of Zurich discussed how empirical studies provide mixed results on a physical climate risk premium. Dr. Gostlow showcased his new estimation method which finds that climate risk is undervalued and mispriced by investors.

- Seunghoon Lee from the University of Missouri presented on the overlooked costs of high tide flooding, noting that even non-destructive floods reduce infrastructure visits and rental rates.

Day 2 – Adaptation

Day two began with an enthusiastic keynote by Matthew Kahn of the University of Southern California, who emphasized the role of market signals in driving innovation for climate adaptation. Kahn argued that excessive government intervention could stifle progress, advocating for a balance that encourages private-sector solutions.

Following the keynote speech–climate adaptation remained the theme of each research presentation– with focus on insurance and infrastructure respectively:

- Dayin Zhang of the University of Wisconsin-Madison discussed how imperfect enforcement of flood insurance leads to misallocated resources and significant welfare losses.

- Judson Boomhower of UC San Diego shared research on wildfire insurance, revealing how firms using coarser risk measures often overcharge high-risk areas or refuse coverage, exacerbating risk inequities.

- Matteo Benetton of UC Berkeley discussed the economic benefits of Venice’s sea wall. His findings estimated the capitalized benefits of the sea wall at around €1 billion, approximately 15% of its cost.

- Yichun Fan from MIT shifted the focus to maintenance, highlighting how underfunded climate resilience infrastructure, particularly in low-income neighborhoods, leads to a destructive feedback loop of declining property values and fiscal capacity.

The final paper session of the symposium examined how the real estate market is learning—slowly—about climate risk. Dongxiao Niu from MIT revealed that property appraisers frequently overlook flood risks, leading to overvaluation in refinance appraisals. The research emphasized that appraisers tend to adjust only after personal exposure to climate disasters. Masashi Takahashi of Pennsylvania State University explored how corporate real estate contracts adapt to climate risk, with recent hurricane experiences leading to more robust clauses in lease contracts, such as those covering Force Majeure or insurance.

Industry Engagement

The symposium concluded with two engaging industry panel discussions–one on the multifaceted nature of ESG in Real Estate and the other on Climate Risk. The ESG panel started with a presentation by Dr. Bram van der Kroft from MIT/CRE on investor engagement and sustainable retrofitting. His presentation highlighted the role of timing in effectively nudging firms to change their sustainable performance through retrofitting depreciated real assets. The panel continued with Jill Brosig of Harrison Street, who addressed the social issues in sustainable retrofitting, and Rachel Horwat of Ivanhoe Cambridge, who analyzed the environmental concerns of ESG in the built environment. Luis Claudio from Finvest, analyzed sustainable performance improvements in developing new real estate, where sustainability could be attained right from the start, given sufficient financing opportunities.

The panel consisted of Timothy Judge of Fannie Mae; Carlos Martín at Harvard; Jessica Shui of the Federal Housing Finance Agency; Katherine Taylor from Freddie Mac. Together, they provided insights on the research gaps in several critical areas: (1) migration; (2) insurance-related research, research for drought, and more research on multifamily housing; (3) transition risk, including the impacts of building performance standards; (4) systemic risks, the intersection of disadvantaged communities with climate risk, and the intersection of housing affordability crises and climate crises. The audience showed strong engagement in this discussion. Some researchers asked about how their research could be used for practice and others received ideas for the next projects from the fruitful discussion.

Call to Action

The MIT Climate Change and Real Estate Symposium highlighted the immense challenges posed by climate change to the real estate sector while offering a platform for collaboration across disciplines. The discussions reinforced the need for actionable research, better data, and innovative policies that can help mitigate the risks while fostering adaptation. As the event came to a close, it was clear that academia and industry must work together to navigate an uncertain future shaped by climate change.

For full details on the MIT Climate Change and Real Estate Symposium speakers and sessions, visit the symposium website or learn more about the Center’s Climate and Real Estate Research.