Quantifying Climate Shocks

Acute climate crisis events, such as hurricanes and wildfires, leave a visible wake of human, property, and environmental damage which is often central to quantifying the economic toll of these events. But what are the long-term financial impacts of hurricanes on the transaction prices of commercial real estate in the US? How do commercial real estate investors respond to those climate shocks? What might those trends suggest for improving climate resilience and more sustainable real estate practices?

In the working paper, “Quantifying the Impacts of Climate Shocks in Commercial Real Estate Market” published on the MIT Center for Real Estate’s (MIT/CRE) SSRN Working Paper Series, researchers analyze the effects of climate-related events on the commercial real estate market in the U.S. The study uses a novel dataset of property-level information and climate data to estimate the impact of “climate shocks,” in this case, hurricanes and floods, on property values and rents. The paper focuses on two of some of the most destructive, billion-dollar, climate crisis fueled events in recent US history– Hurricanes Sandy (estimated at $65 billion of damages in New York) and Harvey (estimated at $125 billion of damages in Texas)1. The authors of the paper include MIT/CRE’s Siqi Zheng, Rogier Holtermans of the University of Guelph, and Dongxiao Niu from Maastricht University.

Market efficiency could be improved by providing more accurate climate risk information and increasing the awareness of climate risk.

Siqi Zheng

This study complements existing research by estimating the capitalization of climate shocks in commercial real estate owned and operated by sophisticated investors (compared to the common household owners of residential real estate). Author Niu explains, “there are still some unanswered questions regarding the response of the commercial real estate market to all these shocks,” so utilizing her expertise and her co-authors’, “we sought to explore potential value changes in commercial buildings following natural disasters and identify the factors that influence this price effect.”

Investigating how hurricane damage affects transaction prices

By analyzing the response of commercial properties held by various investor types to climate events, the paper offers a “more comprehensive understanding of how climate shocks affect commercial real estate values and the mechanisms driving them,” says Niu. Notably, their findings suggest that newly disclosed flood risk-related information may lead to larger price discounts, and investors with spatially diverse portfolios may be better equipped to hedge against climate risks. These insights have significant implications for the commercial property market and add to further reasoning to aim for sustainable development.

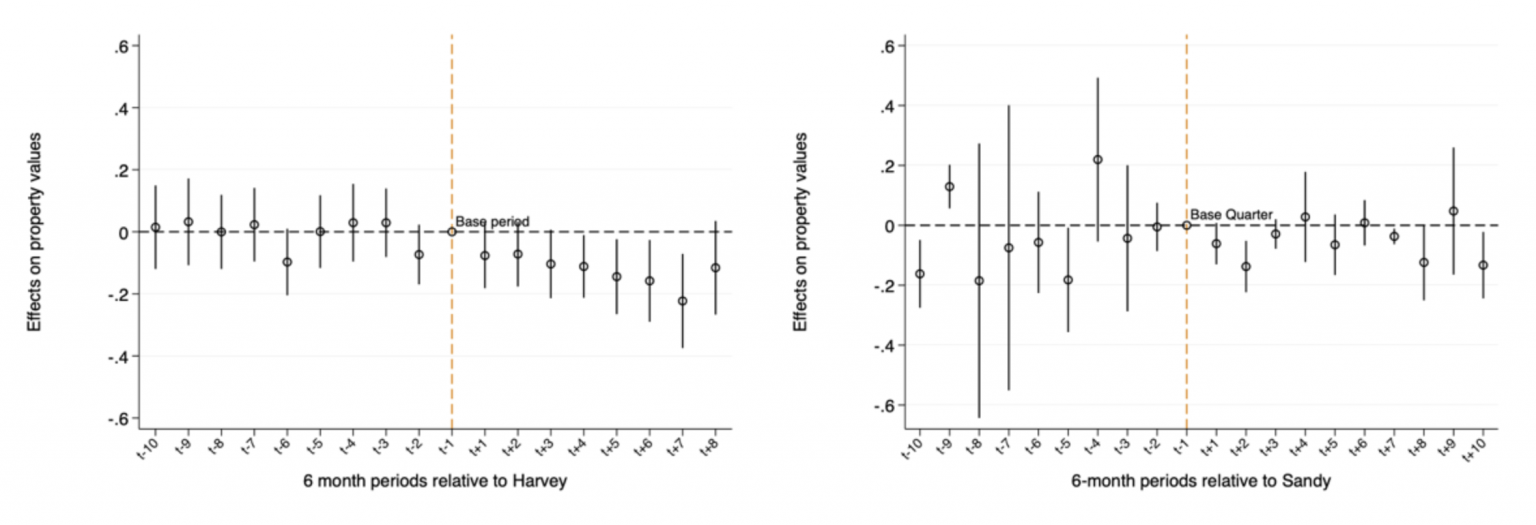

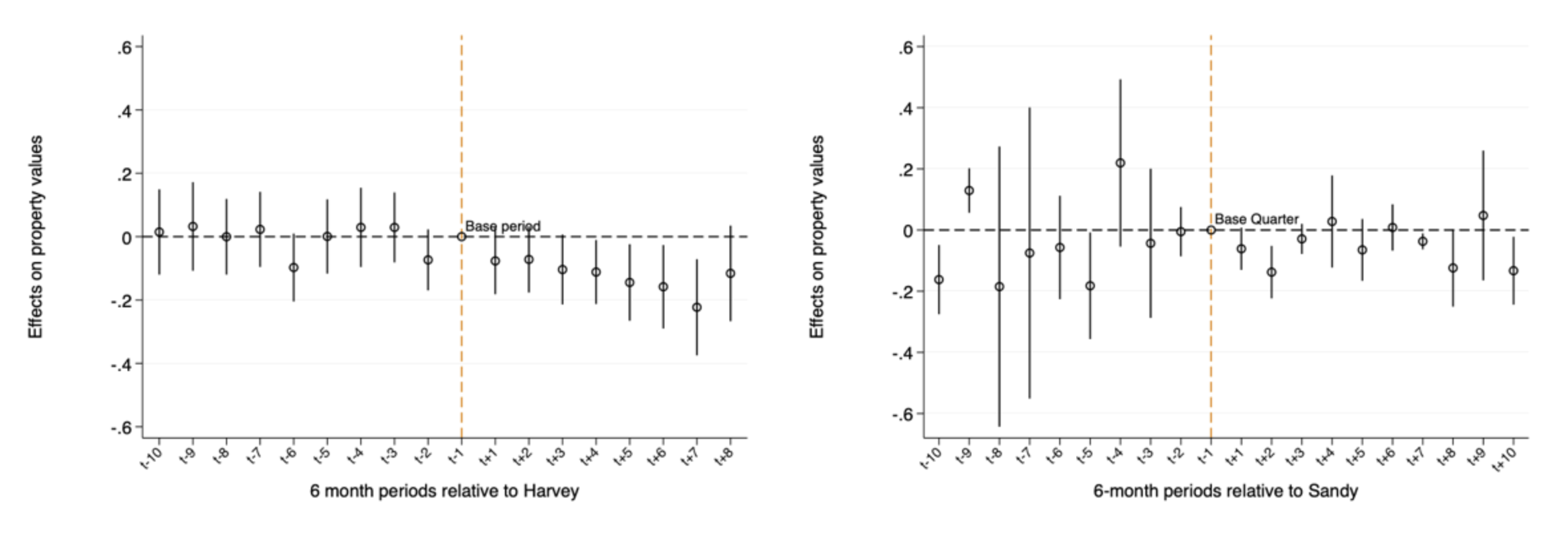

After a hurricane makes landfall, the authors found that in hurricane-damaged areas there was a decline in transaction prices by 1.5% to 3.5% for every one standard deviation increase in flood surge level, compared to unaffected areas. In New York, this effect was short-lived, lasting about one year after Hurricane Sandy. However, in Texas after Hurricane Harvey transaction prices started to show signs of recovery after four years. The authors also discovered that areas outside the flood zone, but still affected by the hurricane, saw larger price declines. Holtermans explains why this may be happening, “The primary reason is people originally thought those areas were relatively safe, but hurricane shocks urged them to update their risk perceptions”.

Holtermans is Assistant Professor of Real Estate Finance in the Gordon S. Lang School of Business and Economics at University of Guelph. His research focuses on the financial implications of information asymmetry and sustainability in real estate markets.

Niu is a postdoctoral researcher at Maastricht University’s School of Business and Economics. Her research areas are in urban economics and real estate, with a focus on climate risk in real estate markets.

Zheng is MIT/CRE’s faculty director and the STL Chair Professor of Urban and Real Estate Sustainability, her research specialty is in urban and environmental economics, with a focus on sustainable urbanization, sustainable real estate, emerging economies’ urbanization. Zheng just launched MIT/CRE’s “climate and real estate” research agenda – read the coverage in MIT News.

“Our results indicate that market efficiency could be improved by providing more accurate climate risk information and increasing the awareness of climate risk, which may lead to higher insurance take-up and more active adaptation strategies towards future climate risk,” says author, Siqi Zheng.

Read the full paper: “Quantifying the Impacts of Climate Shocks in Commercial Real Estate Market”

- NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2023).https://www.ncei.noaa.gov/access/billions/, DOI: 10.25921/stkw-7w73